PULSE MARKET UPDATE - October 2024

Commentary

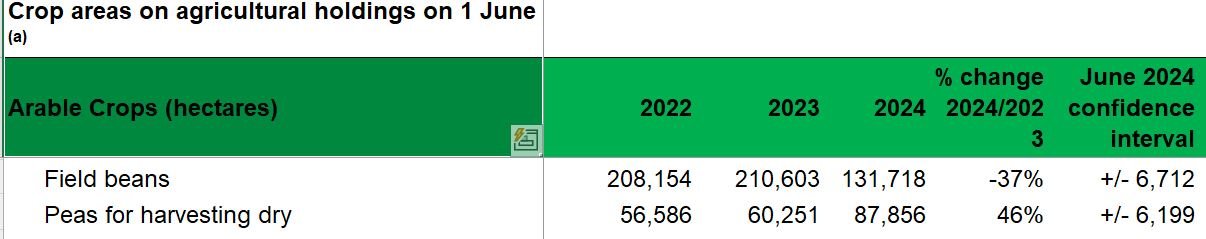

As we release this issue the crop areas for 2024 have been released from DEFRA.

The trade has long suspected that there would be a fall in bean crop area initiated by the poor winter and spring drilling opportunities at the turn of the year, but the dramatic drop in bean area suggested will have exceeded the forecast of most. Equally there is some incredulity at the declared area for peas, with many believing that the area is considerably over estimated. On the face of it this would seem to indicate a potential drop in available beans, but we also know that the average yield of both peas and beans was significantly up on the 2 previous harvest years.

None of this is really helpful for trading when trying to judge available supply against demand and we now find ourselves up against the window for winter bean drilling. So far winter bean seed sales appear to be significantly down, but whether this is due to planting decisions, farm saved seed, over year seed from intended 2023 sowing, or selection of alternative options for cropping or land use payments from the SFI is unknown. There is a lot of uncertainty not only for the outcome of crop 2024 but also prospects for the 2025 crop area.

UK Pulses

Feed Beans

The newly issued crop area figures do nothing to clarify the availability forecast but perhaps nudge in the direction of those anticipating the lower range expressed in the last bulletin. Nearer to 500,000 tonnes than 620,000 tonnes might be expected.

There is little external export demand to Europe, with buyers either making alternative protein purchases having viewed UK sourced beans as too dear or simply waiting to see what happens in the general commodity market, securing requirements on a hand to mouth basis. Delays to the implementation of soy importation restriction in Europe have also weighed on the actions of buyers.

Bean prices have remained remarkably stable since harvest and even the recent rally in Wheat values has had little impact on the bean offering.

UK demand is also slow. The inclusion rate of beans in compound feed is 50% down year on this time last year. The higher prices of a few weeks ago stimulating buyer interest in cheaper alternatives such as rape meal, DDGS and even palm kernel expellers (PKE). Competitive bean offers were slow to materialise and the later harvested crops were wetter, needed drying and were consequently delayed reaching the market. Buyers in general lack enthusiasm and growers equally, seem to have their attention elsewhere – perhaps focussing on autumn drilling and even in some more Northern locations the remnants of harvest.

Traders are not finding selling easy so realistically, speculating offers of £210 to £215/t ex farm might obtained depending upon location.

Export beans for human consumption

Slow to start some activity is emerging in this market, starting with containerised and bagged produce. The Egyptian market is now also open to business, having had sufficient carry over of old crop Australian produce.

The Australian crop has not been without difficulties this year and while anticipated to be of a similar size the Southern crop is considered relatively poor. Australian harvest of northern bean crops starts in October but traditionally it is the southern region that has been the main source of exports and the potential need for extended internal shipment from the north may mean a 3 month, delivery time to Egyptian buyers. This extends the potential European window for supply a little.

The early Egyptian market trades have been dominated by suppliers from the Baltic region, with early cargoes having started to arrive this month. Quality of these shipments has not been as high as previously expected and this leaves some room for optimism. That said the importers are now much better equipped to clean upon arrival and can split dress cargoes for different local markets, removing some of the perceived value.

That said good quality will always sell and a premium over feed beans of £20-£30/ tonne ex farm might be realised for good visual samples with low insect damage and low staining.

UK combining peas

Samples received by the trade to date have generally been of good colour with lower levels of bleaching. Although some of the later harvested crops have lower quality, suffering from greater incidence of waste and stain.

In general yields have been much improved and with that in mind trade has been concentrating on servicing growers with production contracts.

As most peas are currently grown on contract, with various clauses for quality and values pre-determined. Price indications below refer to produce offered in the free market.

Green peas

Micronisers have continued to lead this market when in need, demanding the best visual quality and being prepared to pay for it, but as buyers they are not ever present and more regularly prices of around £325 - £365/t ex farm have been realised, depending upon appearance and cooking qualities.

Contracts for crop 2025 are available offered on variously negotiated ex farm basis’s, typical might be a £300/t minimum to £400/t maximum, or alternatively on fixed prices with bonus options at values in between.

Marrowfat peas

The UK yield and quality from crop 2024 has generally been good, but from a trading perspective this market remains under great pressure with alternative supplies making their way from Canada into Eastern markets at comparatively very competitive prices. The £500/t plus, ex farm value, that many producers have recently assumed as an expectation is now coming under pressure.

Contracting for Marrowfat pea production for crop 2025 has largely paused until a more certain picture on availability is realised. If interested speak to your merchant.

Yellow peas

Yellow peas find themselves in surplus under pressure from imports and international trades and a range might be expected between £320/t - £350/t ex farm, with the higher values being for superb looking samples with niche buyer interests such as bird feed specialists.

Despite the fact that yellow peas are the leading subject of alternative flour and protein processors, so far that market has failed to significantly develop in the UK.

Contracts will be available for 2025 crop but at a low level and those interested now, should contact their merchant directly.

Maple peas

Maple pea demand continues to be strong and supply weak. As a result prices of up to £450/t ex farm might be achieved. Variety Mantara has tended to yield higher than variety Rose, but when available Rose carries a human consumption value premium, with Manatra being a pigeon feed buyers favourite.

Crop 2025 contracts are likely to be released it the coming weeks and may be at or around current market values. Contact your merchant if interested at this stage.

Agronomy notes:

Winter Beans : Those seeking to use their own Farm Saved Seed should ensure they have them tested. Do not use seed that tests positive for Stem Nematode. Details of PGRO seed testing services can be found here https://www.pgro.org/seed-testing/

Bean establishment agronomy notes can be found here: https://www.pgro.org/growing-field-beans/

Winer Bean variety selection:https://www.pgro.org/pulse-descriptive-list/

Farm Saved Seed: Frequently asked questions:https://www.bspb.co.uk/faqs/farm-saved-seed/

PGRO Descriptive List:

The Pulse Crop DL for 2025 will be launched at Crop Tec in November https://www.croptecshow.com/

Advisory services:

Concerned with crop issues?

- Send PGRO photos and crop reports from the PGRO App

- Send sick plants to the PGRO plant clinic for diagnosis

- Phone or email PGRO for advice.

Teaser alerts:

The PGRO Agronomy app is having a make over. Look out for information and the relaunch of the PGRO Crop Monitor app at the end of November.

PGRO's 2025 Descriptive List for Pulse crops will be launched at Crop Tec 27/28 November: Event details here https://www.croptecshow.com/

The next Pulse Market Update:

November/ December 2024